Debt Management Plan

A Debt Management Plan is an informal and flexible solution for people who cannot afford their monthly repayments on their debts. It allows you to come to an arrangement with your creditors to pay what you can realistically afford. Anyone in the UK or Northern Ireland can do a Debt Management Plan.

You can negotiate Debt Management yourself or you can use a Debt Management Company to speak to your creditors on your behalf and manage the plan.

In some cases you can offer your creditors a settlement of your debts, if you can offer a portion of the debt owed in one lump sum.

Get Debt Advice

Fill in the form and we will get back to you

What happens in Debt Management?

In a Debt Management Plan, you pay a reduced affordable monthly payment, which is then divided up fairly amongst your creditors. It usually lasts until you have paid all of your debts off, or if your financial circumstances change you might want to opt out of the agreement earlier and go back to paying your debts at the normal rate.

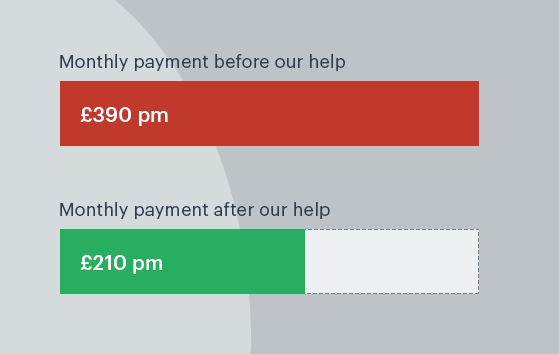

See the example below to understand more about how a Debt Management Plan works.

client with Debt Level of £15,990

Client was struggling to pay £390 each month on credit card and loan debts. In a Debt Management Plan, they were able to get this reduced to £210 per month. They also managed to get all interest and charges frozen with their creditors. They will be paying this until their Debt Management plan is finished (about 76 months) or until they opt out of the plan.

How do I set up a Debt Management PLan?

In a Debt Management Plan your income, outgoings and your debts are analysed to work out what you can afford and to determine if it is your best option for getting out of debt. Your debt management proposal is drafted and the repayment plan is negotiated with your creditors.

A Debt Management Company can aim to get all interest and charges frozen, but it is never guaranteed.

How much will I pay?

How much you pay into your debt management plan is really dependent on your financial situation. Your employment status, income and expenditure, the amount of unsecured debts and number of creditors you have are all considered before working out what you can afford

Advantages of a Debt Management

- An Informal agreement that can be changed/stopped at any time.

- 1 affordable monthly payment to cover all debts.

- You are usually assigned your own case manager for the duration of the plan.

- Interest & Charges could be frozen (if creditors agree).

- All dealings with your creditors go through the debt management company for the duration of the plan.

- If creditors pressure or harass you, your debt management company will deal with it.

- Debts can be settled sooner if you can offer a lump sum payment for a portion of the debts.

- Suitable for tenants, homeowners, individuals, couples and self employed.

- A Debt Management Plan can usually be up and running in a matter of days.

Disadvantages of Debt Management

- A Debt Management Plan will remain on your credit file for some time after completion if a default notice has been issued.

- If creditors refuse to freeze or reduce interest this can lead to increased debt level.

- Debts will be repaid over a longer period of time than if your contractual payments were made.

- Debts must be repaid in full (unless offering a lump sum settlement).

- Repaying debt over a longer period may increase the total amount to be repaid.

- Your ability to obtain credit will be affected in the short term and might be affected in the medium to long term.

Can I apply for a Debt Management PLan?

You can apply for Debt Management if…

- You have debts over £1,000

- You have 2 or more creditors (people you owe money to).

- You have a surplus income each month (after all your essential living expenses), excluding debt payments

- You are struggling with your Debts

making my Debt Management Application

To apply for Debt Management you usually need to provide the following things

- A full list of all of your creditors you owe money too and the current debt levels. Including all store cards, loans, HP agreements, catalogue debts, unpaid utility bills etc.

- Any assets that you own including your house, cars, policies etc.

- A breakdown of your monthly household bills and income and expenditure.

Contact us

Get in touch with Debt Advice NI and get help with your debts. Call us now on 0800 043 0550 or click here to visit our contact page.

Excellent company

Gave me help advice and confidence to deal with a very large and stressful financial situation that I could see no way out of. Many thanks. | Client review

Read more...

About us

Debt Advice Northern Ireland is owned by McCambridge Duffy who are one of the leading Insolvency firms in the UK and have been in the financial industry since 1932. McCambridge Duffy solely provide IVAs and other Insolvency solutions.

On our site you will find information on debt solutions, both formal and informal. We provide this information so you have a clear overview of the options available for dealing with your debts. We do not offer informal debt solutions, so if an insolvency solution is not your recommended course of action, with your permission, we will refer you to an appropriate agency/provider that can assist you further.