An IVA is a formal solution that can help you deal with debts that you can't afford to pay. In an IVA you are completely protected from creditors and interest & charges are stopped. You will have lower affordable monthly payments and on completion of the arrangement, any unpaid debts are legally written off. Fill in the form to find out if an IVA could help you with your debts, or read on to find out more information.

Fill in the form and one of our advisers will get back to you.

All advice is free & confidential. Your information will not be passed to any 3rd parties.

Gave me help advice and confidence to deal with a very large and stressful financial situation that I could see no way out of. Many thanks. | Client review

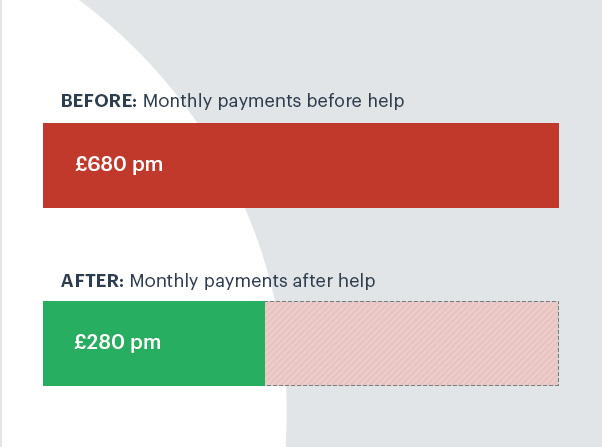

In this example our client came to us with several debts totalling approximately £26,850. Due to a change in their circumstances, the monthly debt repayments became too difficult to manage and they were unable to afford the payments of £680 per month.

After determining if an IVA was the best option for their situation, we were able to successfully negotiate an IVA with their creditors. The debt repayments were reduced to an affordable amount of £280 per month for the duration of the IVA (60 months).

On completion of the IVA our client will repay £16,800 towards their debts. The remaining £10,050 will be written off and our client will be able to start over debt free.

When you speak to us, we will run through your financial situation with you. We carry out a brief analysis of your income, expenses, debts and your circumstances. This allows to determine how much you can afford to pay towards your debts each month. The amount you can afford each month and the level of your debts will help us work out what options are available to you for dealing with your debt. If an IVA is your best option and you would like to proceed, then we will start working on your IVA proposal.

In order to propose an IVA you will need the help of an Insolvency Practitioner (IP). An Insolvency Practitioner is the professional who is qualified to set up and negotaite your IVA. It is not something you can do yourself. The proposal is sent to your creditors for voting. This is known as the Meeting of Creditors. If 75% of your creditors (by debt value) agree to the proposal, then your IVA is accepted and you can begin with your new repayment plan. We can have an IVA up and running in as little as 4 weeks. After 60 months (usual term of an IVA) you are free of your debts and monthly repayments. Any remaining unpaid debt is written off.

Almost anyone can do an IVA. You can be single, married, employed, self-employed, a homeowner or a tenant... But there is certain criteria regarding your debts and finances. An IVA is suitable for anyone that has

Anything you need to pay regularly is classed as a living cost. eg Mortgage/Rent, Food/Groceries, Clothes, Travel/Transport, Vehicle costs, Council tax, Electric, Gas, Heat, Phone/Mobile/Internet, Childcare etc... You are allowed a budget from your income to deal with all of these expenses. We follow certain guidelines that allow us to allocate a fair amount to your household budget. When we discuss your situation, it is important that you mention every single expense you can think of, so that we and your creditors can get the full picture of you circumstances and what you can afford to pay. There may be extra budget allowed if you have special circumstances.

The first thing we will do is determine if an IVA is your best course of action for addressing your debts. We will need information on who you owe money to, including credit cards, store cards, loans, overdrafts etc... We will discuss any assets you might have, including property, vehicles, policies etc... And finally we will analyse your household bills, income and expenses. We can discuss all of this with one brief phonecall. Once we have all required info we will be able to confirm if an IVA is your best option and if other solutions might be available to you also. We will discuss these too. If you decide to proceed, we will explain everything in detail, including what happens next in the IVA Application process.

Unlike some companies, we do not charge any upfront fees for doing your IVA, which saves you both time and money when it comes to applying for your IVA. Also, your IVA is not guaranteed until your creditors accept your proposal, which is another advantage of having no upfront fees. You do not lose out on any money that would have been paid if your IVA is not accepted.

Only if your IVA is accepted will we receive any payments for setting up and managing your IVA. Our payments are built into your agreed monthly payments to your creditors, which is all outlined in your IVA proposal, so you never receive a bill from us. It is your creditors who determine what we get paid and we cannot draw any fees without their approval.

Typically an IVA can last for about five years, but in some cases this can be extended. It is also possible to do an IVA in a shorter period of time, if you can produce a partial or full lump sum of money. The good thing about an IVA agreement is you will know exactly when it is complete as it will be outlined in your agreement.

While you are in an IVA you will understandably not be able to obtain any sort of credit and you will not be able to use any form of current credit that you have. This will be the case until your IVA is complete. So, although your credit rating is affected, it is not forever. Your credit rating will begin to repair after you have completed your IVA.

With over 80 years experience in the finance industry we provide a reliable debt advice service, with helpful and friendly staff on hand to listen to your debt worries, no matter how big or small they may be.

We have a very high acceptance rate for IVAs proposed. We only propose IVAs that we believe will have a good chance of being accepted by your creditors. We also fight very hard for every client to make sure their IVA proposal is carefully considered by the creditors.

We are one of the few IVA companies that do not charge any upfront fees. Paying any provider upfront fees will only cause a delay your IVA being accepted and cost you extra money that is completely unnecessary. If your IVA is rejected you will lose this money. DO NOT PAY UPFRONT FEES EVER!

We have a fast IVA set up and can have your agreement set up in as little as 4 weeks.